Thursday, 02 September 2010/ The Independent

Anis Alamgir

Nearly 7 lakh tax payers in Dhaka and Chittagong, two of the country’s largest cities have reasons to cheer.

The Government is all set to launch two Service Centres in Dhaka and Chittagong for collecting Income Tax (IT) returns from the 15th September. The proposed tax paying system cuts down on paper work and sets up a one stop shop where the tax payers can file their annual returns hassle free.

Once the old tax paying system is refurbished through digitalization officials hope more and more people come within the purview of the tax net. Presently there are about 25 lakh tax payers, of whom only 9 lakh pay their taxes regularly.

However the new system does not apply to the nearly 60,000 private corporations who will continue to file their tax returns as per the old system- for the time being at least.

All Income Tax territorial Zones in Dhaka and Chittagong will execute the plan. Respective territorial zones will open their counters in the centres for receiving tax returns. Tax officers will assist the taxpayers in filling in their tax returns.

The move initiated by the National Board of Revenue (NBR) is part of the Government’s larger policy of digitalizing all its operations – both to optimize revenue collections as well as to make the system customer friendly.

The large scale changes are being planned with help from the Indian government.

Already a ten member delegation from the NBR headed by the Secretary, Internal Resources Division of Finance Ministry and the NBR Chairman has just recently returned from India after viewing the functioning of digitalized tax collection by the Revenue Department of the Government of India.

Coming back to the proposed new tax payment system in Dhaka and Chittagong, the Government owned Sonali Bank/ Janata Bank will open their temporary booth at Service Centre for collection of challans and issuance of pay order.

For convenience of the tax payer photocopier service, caféteria, toilets and other facilities make available at the centres.

According to the digitalization plan all application software for the three wings of NBR and relevant databases would be made operational at the earliest with establishment of a centralized Data Centre for NBR and networking-NBRNET-for moving ahead with the above mentioned recommendations, an official told this newspaper.

Separate teams from Customs, Income Tax and VAT are planning to visit India to take a closer look. Indian experts would also be invited to assist NBR in preparing a road map of implementation.

The Government is also likely to send study teams to Singapore, Malaysia, Australia and New Zealand to understand how taxes are paid outside South Asia.

The delegation has also suggested a number of recommendations for the NBR including reforms of administrative structure so as to expedite the revenue collections.

According to the digitalization plans, the NBR also proposes opening a Call Centre with hunting line by January next. A dedicated workforce will perform as operator at call centre and Frequently Asked Questions (FAQs) are available in its Computer.

The NBR will open a Central Processing Centre (CPC) as a Central Data Centre of the organisation for the purpose of centrally processing the IT Returns (both manual and digital). Manually submitted Returns would be in machine readable forms for easy digitization of data. It will be launched by July 2011.

The NBR and all income tax territorial zones will open a Taxpayer Service Centre (Help Desk) from this month. This service centre will perform as a window for the respective zones. IT Returns and all kinds of IT forms and circulars shall be readily available at the Service Centre. The centre can also issue TIN certificate and certified copies.

The NBR is also planned to open centres for collection of salary tax returns centrally in Dhaka and Chittagong by July next year. System will process the IT return and assessment order and to be dispatched to the taxpayer by postal mail. Refund voucher also to be sent with signature of the Tax Officer by postal mail.

Strengthening of BCS Taxation Training Academy, development of NBR website, and the Development of Systematic and Dynamic Risk Management System (RMS) for Customs including Valuation Database with alerts for sensitive items are also on the list of NBR's development plans.

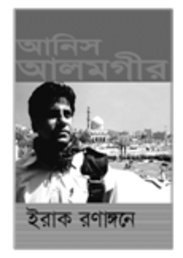

Anis Alamgir is a senior journalist of Bangladesh with over two decades of long career in print and electronic media. He has covered a number of important international events, including Iraq war (2003) and Afghan war (2001). The Iraq war assignment, being the only journalist from Bangladesh, was for about 2 months that included live dispatches and interviews from the battlefields. He was arrested by the Taliban during the Afghan war in 2001 in Kandahar.

my book

Cover of my book on Iraq War. “Iraq Ranaggone”—In Iraq war field, pages from a war reporter’s diary.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment